ON FEBRUARY 24, PRESIDENT TRUMP IS

EXPECTED TO SIGN HIS FINAL ONE — EVER!

Ian King here with some very big news.

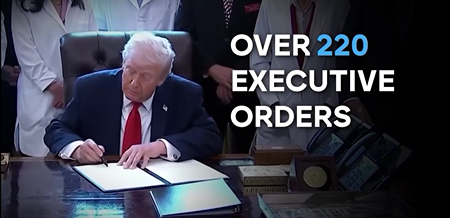

After 220 Executive Orders in one year. And with nearly three full years left in office…

I have learned the unthinkable…

On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order.

I know that sounds crazy …

I didn’t believe it myself.

But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement.

I was able to get the full story for you here.

Regards,

Ian King

Chief Strategist, Strategic Fortunes

BioTech Breakout: MoonLake Up 30% On FDA Wins

By Jeffrey Neal Johnson. Published: 2/3/2026.

Quick Look

- The FDA recently granted Fast Track designation to MoonLake Immunotherapeutics' lead drug for a severe skin condition while clearing the path for a major filing.

- Management maintains a robust balance sheet that provides a cash runway extending well into the future to support ongoing clinical development plans.

- Rising share prices and upcoming data readouts could pressure short sellers who bet against the stock now that the period of uncertainty has passed.

In a stock market focused on interest rate cuts and the artificial intelligence (AI) boom, it is easy to overlook the biotechnology sector. But for investors willing to look beyond the Magnificent Seven, clinical-stage biotech remains one of the few places to find event-driven returns that can be largely independent of the broader economy.

MoonLake Immunotherapeutics (NASDAQ: MLTX) is illustrating that point in real time. The stock jumped roughly 10% in the first trading days of February, pushing the price above $16. The move is part of a broader recovery — shares are up more than 30% over the past month. While volatility is inherent in this sector, MoonLake's rally is grounded in a string of concrete regulatory wins that have materially changed the company's outlook.

Clearing a Path: The Month of Regulatory Wins

[How To] Invest Pre-IPO In SpaceX With $100! (Ad)

For the first time ever, James Altucher – one of America's top venture capitalists – is sharing how ANYONE can get a pre-IPO stake in SpaceX… with as little as $100!

[[Click here now to view.]]The most recent rally began on Feb. 2, 2026, when the U.S. Food and Drug Administration (FDA) granted Fast Track designation to MoonLake's lead drug, sonelokimab, for the treatment of palmoplantar pustulosis (PPP).

PPP is a severe, chronic skin condition that causes painful blisters on the palms and soles. There are currently no approved treatments for PPP in the United States, representing a significant unmet need.

"Fast Track" might sound like a generic buzzword, but it has practical value. The designation is granted by the FDA to therapies that show potential to address serious conditions and offers tangible advantages:

- Access: More frequent interactions with the FDA, which helps ensure the company stays on the right development path.

- Speed: Eligibility for Rolling Review, meaning MoonLake can submit completed portions of its application for review as they are ready instead of waiting to file everything at once — potentially shaving months off the approval timeline.

This news followed an even more consequential development.

On Jan. 8, 2026, the company announced the outcome of a critical Type B meeting with the FDA about its primary target, hidradenitis suppurativa (HS). This was a turning point: MoonLake's stock plunged in 2025 after mixed HS trial results, and investors feared the FDA would require a new, costly multi-year study.

Instead, the FDA confirmed that the existing data are sufficient to support a filing. That was a major de-risking event. By clearing the path for HS and granting Fast Track for PPP, the agency has effectively validated MoonLake's platform technology: the nanobody. These smaller, single-domain antibody fragments can penetrate inflamed tissue more easily than traditional antibodies. Positive regulatory signals in two different diseases suggest the platform is working, shifting MoonLake from a speculative bet to a company with a viable, multi-indication pipeline.

Cash Is King: Funded Through 2027

Biotech investors often worry about dilution when a small company's stock rebounds, since companies frequently raise capital by issuing new shares. MoonLake, however, is starting from a position of financial strength. In its third-quarter 2025 financial report, the company reported about $380.5 million in cash, cash equivalents, and short-term securities.

In drug development, cash equals time. Based on current burn rates, MoonLake's runway extends into the second half of 2027. That gives management the flexibility to complete regulatory filings and potentially reach commercialization without an immediate need to return to the market for capital. For existing shareholders, that reduces the near-term risk of a dilutive secondary offering and lets the team focus on execution.

Skeptics vs. Momentum: The Setup for a Rally

Despite the regulatory progress and solid balance sheet, skepticism remains. As of mid-January 2026, short interest in MoonLake had risen to about 12.7% of the float.

Short sellers who accumulated positions when the stock was weak likely expect operational setbacks or dilution. But the recent FDA updates have undermined that bearish thesis. If positive momentum continues, short sellers face mounting losses and may be forced to buy shares to cover, which can amplify upward moves. With roughly 12.7% of the float sold short, there is meaningful potential for a short-covering squeeze if the company delivers additional good news.

Investor Day Preview: The Next Big Mover

The recent surge may be just the opening act. MoonLake will host an Investor Day on Feb. 23, 2026, where investors will get more detail on the program and strategy.

The key focus will be the Phase 2 S-OLARIS trial readout for sonelokimab in axial spondyloarthritis (axSpA), a form of spinal arthritis. A positive result would add a third validated indication and further support the drug's utility across inflammatory diseases.

Later in 2026, the company expects to release 52-week data from its HS trials in the second quarter, with a Biologics License Application (BLA) submission targeted for the second half of the year.

Risk, Reward, and Regulatory Alpha

MoonLake Immunotherapeutics has navigated a critical stretch that derails many small biotechs. By securing a clear regulatory path for its lead indication and Fast Track status for a second, the company has materially reduced program risk. Commercial execution and competition remain risks, but the combination of regulatory clarity, a robust balance sheet, and a skeptical market poised for a squeeze makes MoonLake one of the more interesting idiosyncratic growth stories in 2026. Investors seeking event-driven upside should watch its upcoming catalysts closely.

This email message is a paid sponsorship provided by Banyan Hill Publishing, a third-party advertiser of MarketBeat. Why did I get this message?.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here.

If you need help with your account, feel free to email MarketBeat's U.S. based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2026 MarketBeat Media, LLC. All rights reserved.

345 North Reid Place, Sixth Floor, Sioux Falls, South Dakota 57103-7078. USA..

Comments

Post a Comment